Are commodities in a new supercycle?

Commodities are showing a strong comeback. Whispers of a new commodity supercycle are now outright statements.

The prices of oil, metals, and other types of energy plunged significantly last March when the World Health Organization (WHO) declared COVID-19 a global pandemic, and national governments pulled the brake on the economy in an effort to halt the increase in contagions. The unwelcome economic consequences that followed have only been surmounted by the regrettable and countless loss of lives. Nevertheless, only over a year later, today, commodities are showing a strong comeback. Whispers of a new commodity supercycle are now outright statements.

The growingly clear perspective of an end to this pandemic, thanks to the ongoing vaccination campaigns, is injecting hope not only into individuals but into the economy as well. It is clear that the market for commodities is no exception. By the end of 2020, nearly all commodity prices had recovered their pre-pandemic levels and have then continued to grow during the first quarter of 2021. The barrel of Brent crude oil, which closed at $51.22 in 2020, is now quoting at $67.73. Copper, a great protagonist of this recovery, has gone from $7772.24/metric ton in the closeout of last year to currently pricing at $8988.25/metric ton. A similar behavior can be found in most commodities, such as natural gas, coal, and food commodities.

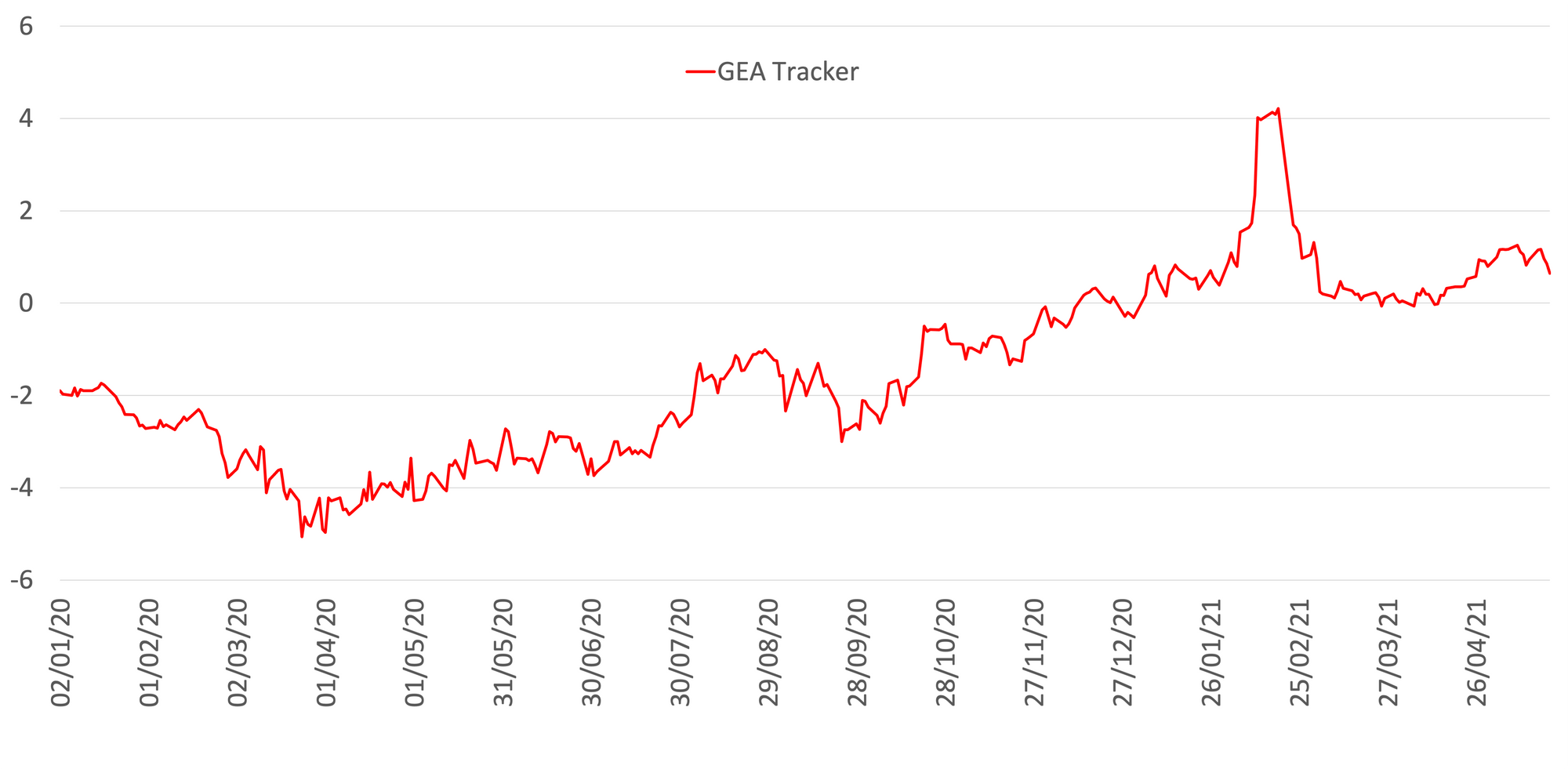

A recently published article by Diaz and Perez-Quiros (2021) underscores the relevance of such fluctuations in commodity prices and the strong relationship between these and the development of global real economic activity. On this basis, the authors developed the GEA Tracker, a daily indicator of global economic activity based on the prices of the commodities that most accurately represent the markets of energy and metals, and that you can now follow in www.360smartvision.com.

A quick look at the GEA Tracker clearly shows a growing trend in global economic activity since the start of the pandemic. The intersection of vaccination campaigns, aggressive fiscal and monetary stimulus, plus the recent hope of the liberalization of patents for COVID-19 vaccines, has resulted in an improving global economic outlook. According to the World Bank, metal prices are expected to average 30% higher this year than in 2020, and agricultural prices are forecasted to average nearly 14% higher.

It is interesting to note that this overall increase in commodity prices has occurred in the context of high uncertainty caused by the emergence of new strains of the virus as well as an uneven vaccination rate across countries. As this uncertainty lessens with time, one should expect commodity prices to increase even further. Moreover, the brink of this commodity supercycle occurs in juxtaposition with the green economy plan, such that this hype in commodity markets is being fueled by the need to heavily invest in green infrastructure for countries to reach their climate goals. While this trend is likely to undercut the demand for fossil fuels in the long run, it is creating a strong cycle for green commodities such as copper, nickel, silver, and platinum in a less distant future.

Notably, the GEA Tracker shows the reaction of commodity markets to China’s five-year plan, Europe’s Green Deal, and Joe Biden’s economic stimulus during the month of February. It is clear that undergoing efforts to reactive the economy include, therefore, the development of large infrastructure projects, which are a tested method for stimulating growth and employment. The forthcoming commodity supercycle is then, hopefully, not only signaling the recovery of the global economy but the tackling of the climate crisis as well.

Referencias

Diaz, E. M., & Perez-Quiros, G. (2021). GEA Tracker: A Daily Indicator of Global Economic Activity. Journal of International Money and Finance, 102400. Link