Implied Volatility as a Global Common Factor

The deep pocket investor restless with portfolio management is constantly gauging the future. The data read of the COVID19 related figures will be almost dead, but still kicking.

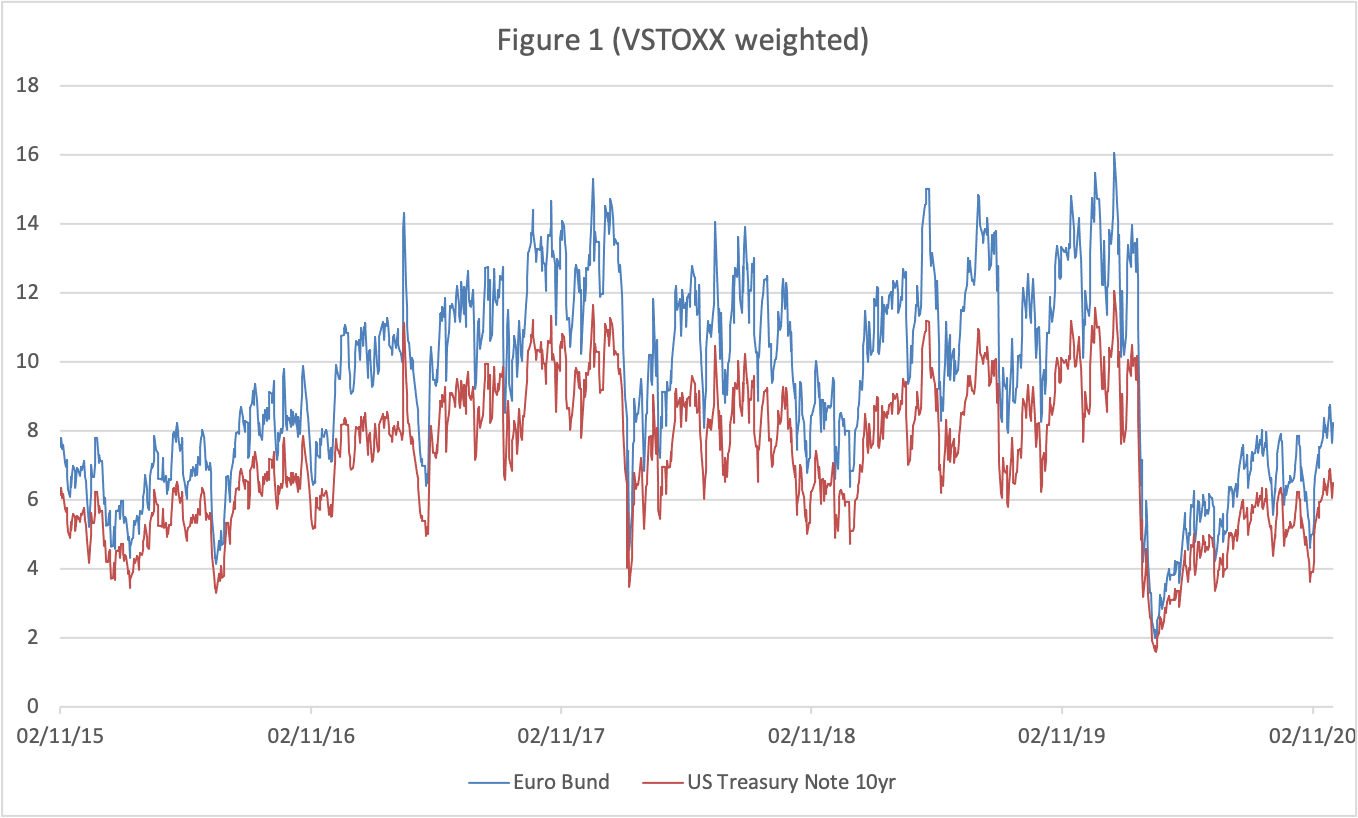

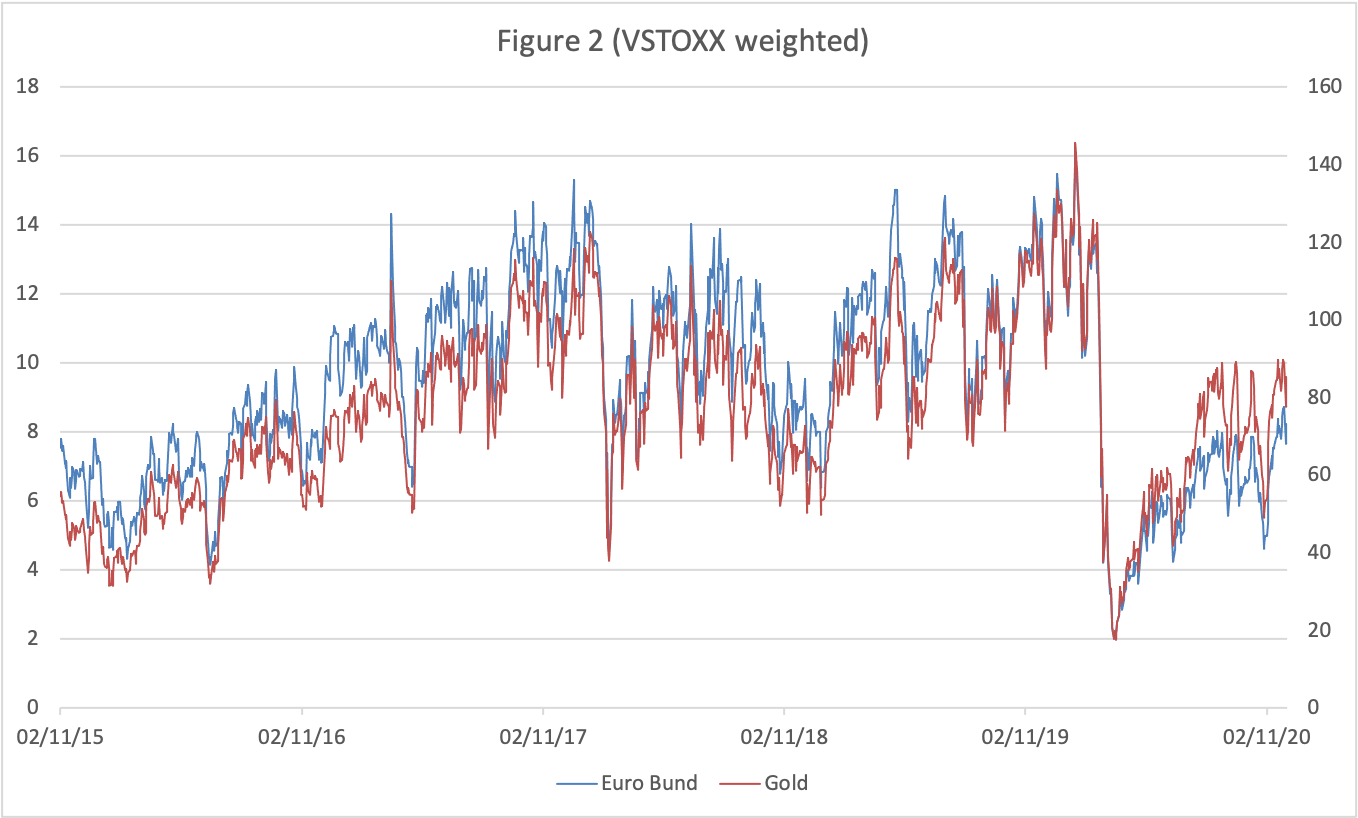

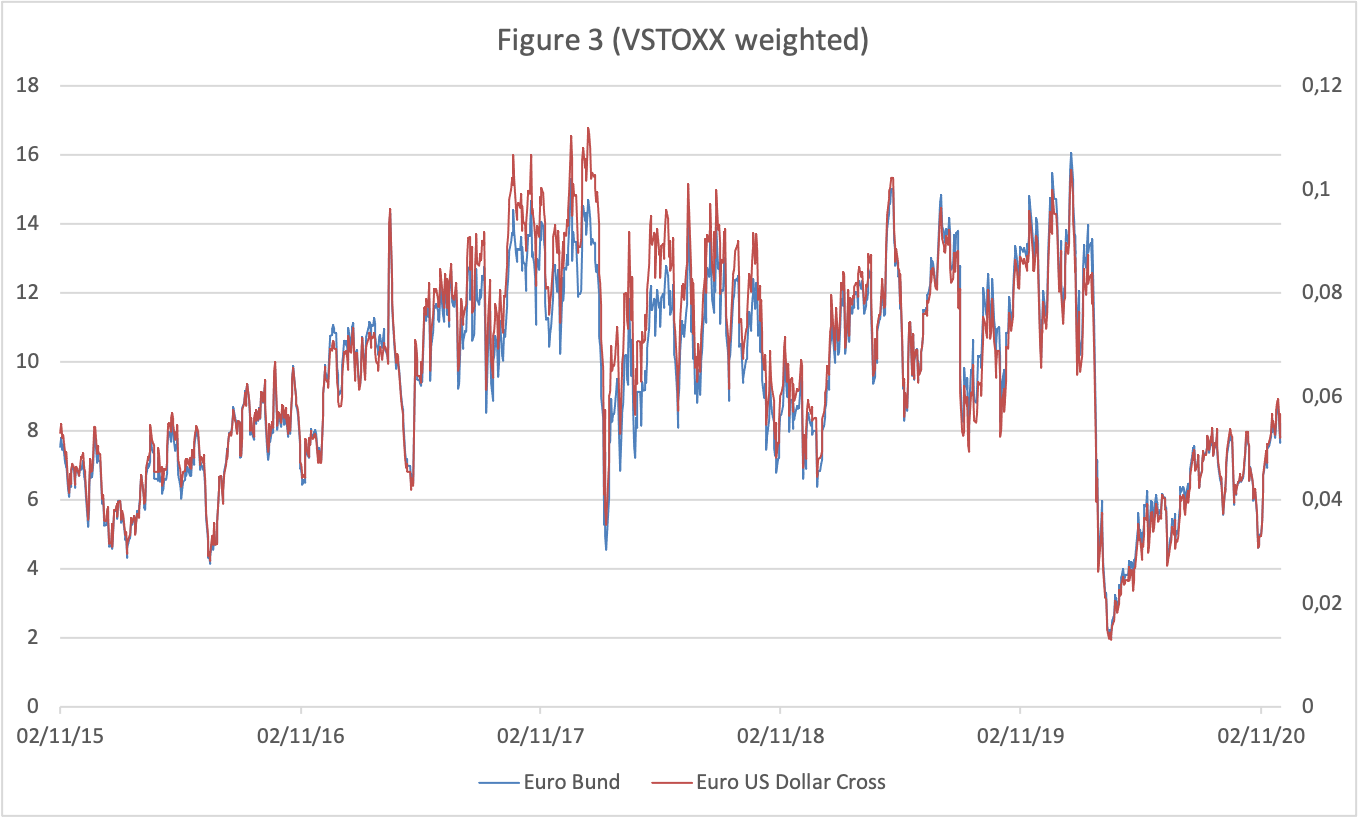

The deep pocket investor restless with portfolio management is constantly gauging the future. The data read of the COVID19 related figures will be almost dead, but still kicking. The central banks are busy, possibly deciding on another market making intervention. The deep pocket investor visits www.360smartvision.com for clues, and chooses the 30 day forward looking VSTOXX monitored by the site and main thermometer of the finance section. It is the future riskiness index traded in the market and discounts future risky scenarios for the world. The best we can do in guessing the future. The opportunity cost of acting now or later when implementing a strategy will be picked up if the investor discounts for all assets by the same risk metric for future scenarios of uncertainty. She uses the same benchmark to compare relative pricing across assets. It turns out that if we adjust three different assets by a common factor they seem to measure the same underlying value. In particular we consider a) the Bund which is the main contract in the European bond futures market and measures the cost of the German 10 year debt security that can be bought or sold b) The EURUSD which is the future contract written on the Euro USD dollar exchange rate, and c) Gold futures as a measure of the so called safe heaven. Looking at figures 1, 2, and 3 we see that they move very closely with small differences that will be adjusted in the near future by the market. These ratios exhibit the same source of risk premium and have a common stochastic progress in time. The deep pocket investor can state that they behave as the same asset. So, is VSTOXX is the common factor that that moves global markets as suggested by www.360smartvision.com?

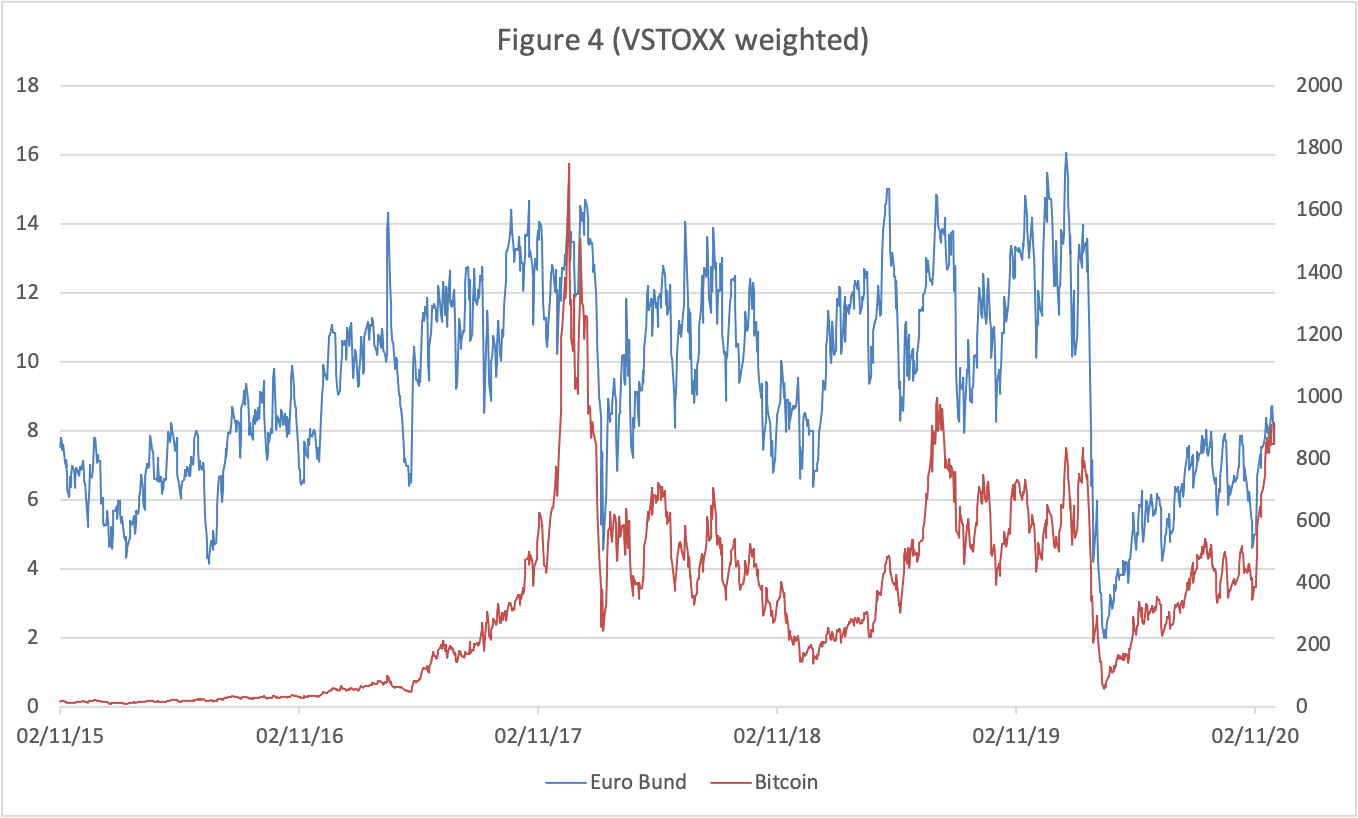

Our investor will diversify risk by allocating some of his wealth to a liquid asset that is not determined by the same market forces as global assets. This could be an investment in crypto-currencies. Let's choose the BITCOIN currency. Changes in future volatility affect the allocation to hedge the bets with alternative assets such as BITCOIN. It turns out that forward looking volatility metrics such as the VSTOXX is also a factor for the crypto-currency in the sense that the time series graph of bitcoin weighted by VSTOXX is in complete tandem with the evolution exhibited in figs 1, 2 and 3. A close look at fig 4 shows that The volatility weighted BITCOIN metric shares common characteristics but outperforms the underlined global investment strategies. The through story is that global asset prices convey common information and jointly react to the expected global risk.